Position Paper: CenSES Energy demand projections towards 2050

12

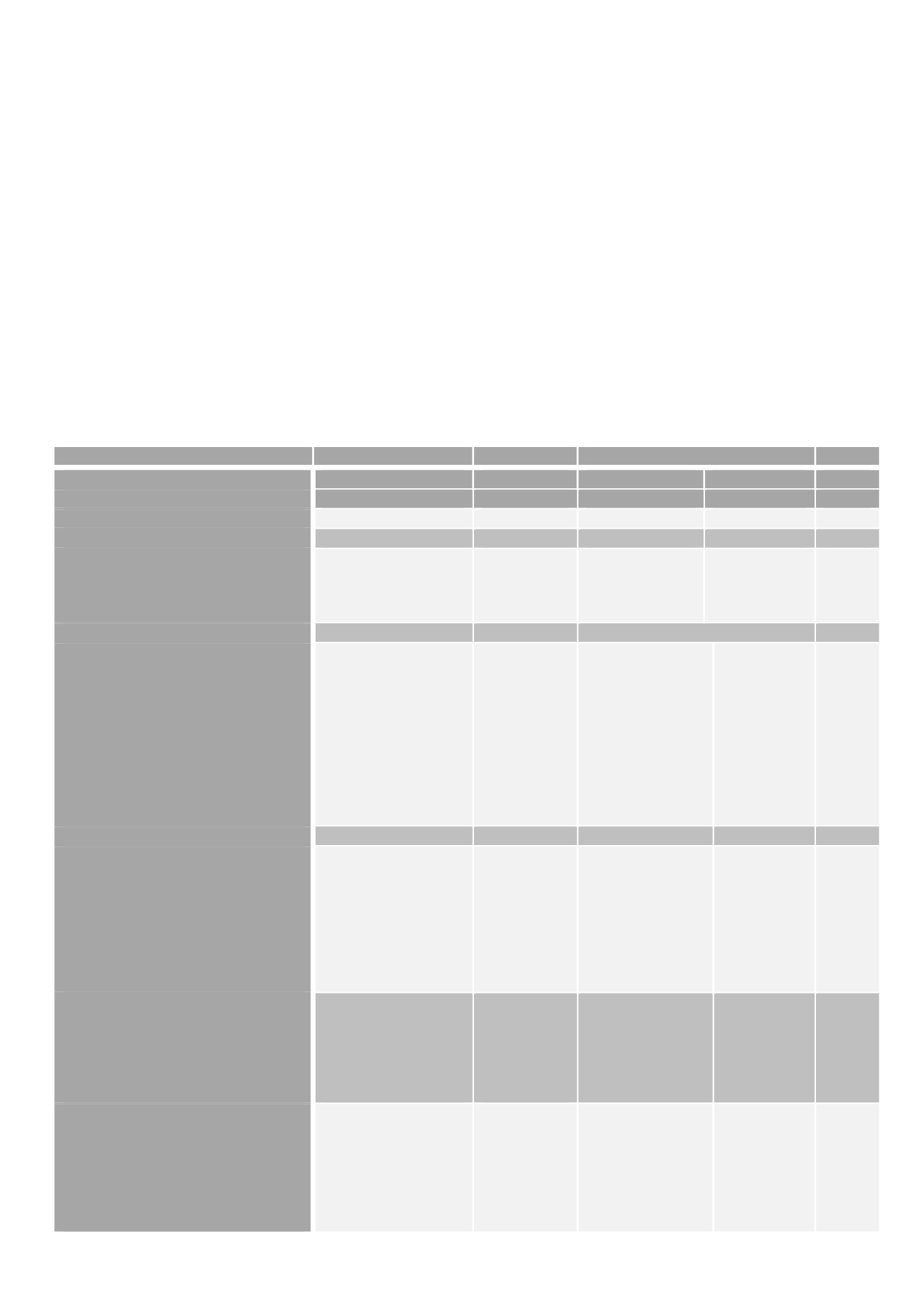

2.3.Assumptions

Different energy prices used as input to TIMES-Norway are presented in Table 3. The energy taxes of 2014 are

assumed to be constant until 2050. From 2020 the tax of biodiesel is assumed to be the same as for petroleum

diesel. TIMES-Norway has a possibility to invest in 2

nd

generation biodiesel production from 2025 and this product

can be used in pure biodiesel vehicles. Imported biodiesel may only be used for mixing with petroleum diesel.

Financial support to specific technologies is modelled with the present level until 2020, and is then removed.

Zero-emission vehicles are exempted from nonrecurring tax and VAT until 2020 and then get the same taxes as

other vehicles. The nonrecurring tax is assumed to be calculated based on the same principles as today until

2050, resulting in a low investment cost of cars using 2

nd

generation bio fuels. The use of electricity for heating

is restricted in accordance with the building regulation code of 2010.

Table 3 Energy prices (incl. energy taxes but not VAT), bio energy potentials and rates used as input to TIMES-Norway

(possible investments in brackets)

All scenarios but LOW Scenario LOW

Potential /Capacity

Other

2016-2050

2050

2020

2050

NOK 2005/MWh

NOK/MWh

General discount rate

4%

VAT households

25%

Hydro and wind potentials

- Hydro

- Wind, onshore

- Wind, offshore

33.8 TWh/year

41 TWh/year

10.3 GW

33.8 TWh/year

41 TWh/year

10.3 GW

Export/Import (+new investment)

Electricity trade

-

SE1

- SE2

- SE3

- FIN

- RUS

- DK

- NL

- DE

- UK

273

245

245

245

245

255

312

259

407

441

441

441

441

441

469

496

484

591

600/700 MW

1300/850 MW

2095/2145 MW

100/100 MW

0/56 MW

1000 (+700) MW

700/700 MW

(1000) MW

(1000) MW

Electricity certificate price

165

0

Grid fee

- Industry, high voltage

- Industry, low voltage, firm power

- Industry, low voltage, occasional

power

- Tertiary sector, firm power

- Tertiary sector, occasional power

- Residential sector

25

144

59

189

101

229

25

144

59

189

101

229

Petroleum fuels

-

Light fuel oil, buildings

- Light fuel oil, industry

- Heavy fuel oil

- Diesel for transportation

- Gasoline

786

498

492

939

1129

1132

815

802

1191

1332

unlimited

unlimited

Bio fuels

- forest chips

- wood logs

- by-products from industry

- fire wood

- pellets, imported

- municipal waste

184-223

150

0-187

107-207

400

250-303

150

0-253

181-281

476

3.2 TWh/y

0 TWh/y

3.9 TWh/y

8.3 TWh/y

unlimited

2.6 TWh/y

4.2 TWh/y

8.6 TWh/y

3.9 TWh/y

8.3 TWh/y

unlimited

2.6 TWh/y

3.3. Assumptions

Different energy prices used as input to TIMES-Norway

are presented in Table 3. The energy taxes of 2014 are

assumed to be constant until 2050. From 2020 the tax

of biodies l is assumed to b the same as for petroleum

diesel. TIMES-Norway has a possibility to invest in

2nd generation biodiesel production from 2025 a d

this product can be used in pure biodiesel vehicles.

Imported biodiesel may only be used for mixing

with petroleum diesel. Financial su port t specific

technologies i modelled with the present level until

2 , and is then rem ved.

Zero-emission vehicles are exempted from nonrecurring

tax and VAT until 2020 and then get the same taxes

as other vehicles. The nonrecurring tax is assumed to

be calcula based on the same principl as today

until 2050, resulting in a low invest nt cost of cars

using 2nd g nerati n bio fuels. The use of electricity

for heating is restricted in accordance with the building

regulation code of 2010.

le 3

Energy prices (incl. e ergy taxes but not VAT), bi energy potentials and ra s used as i put to TIMES-Norway (possible investments

in brackets)