26

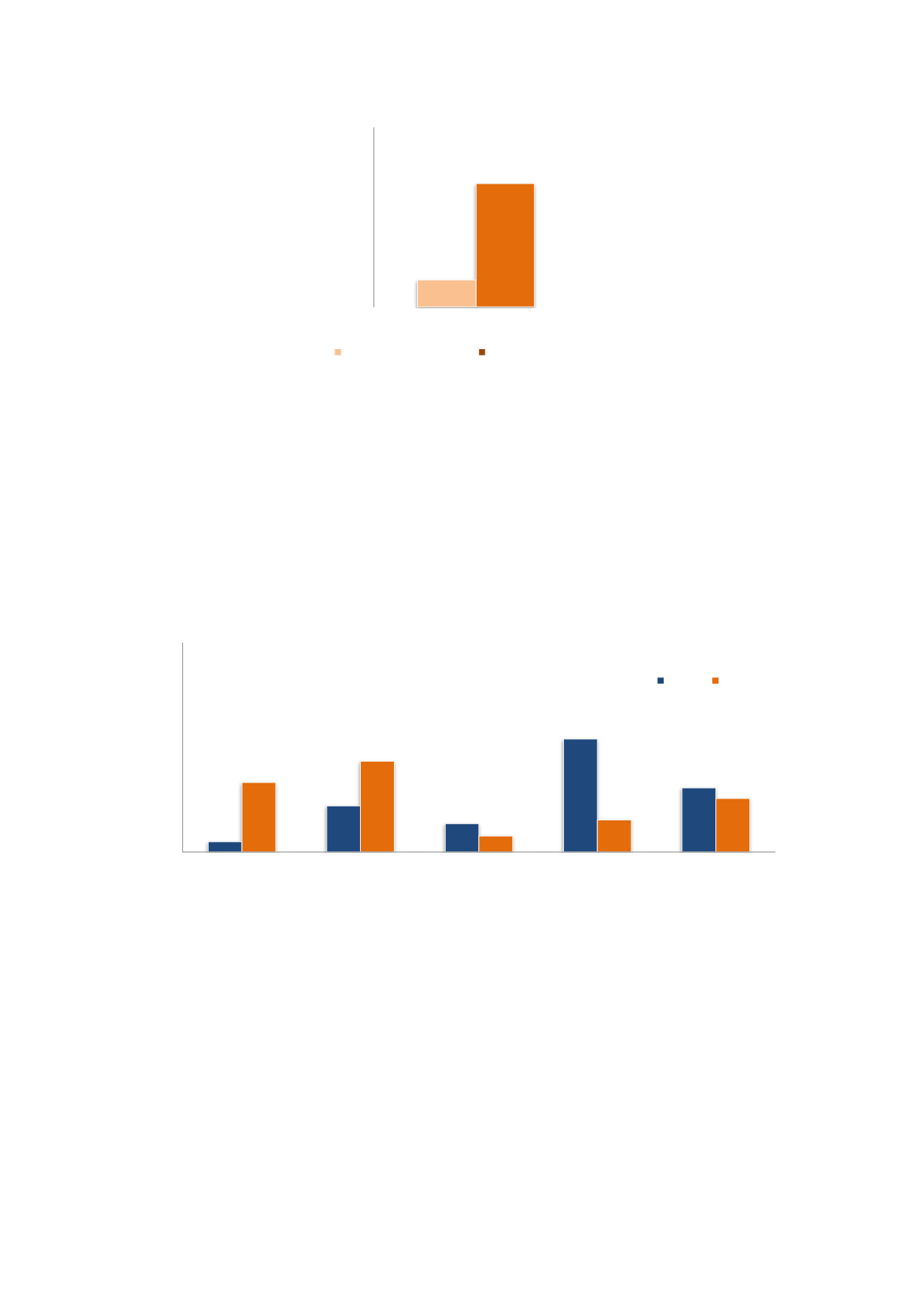

Figure 5-18 Percentage of PV firms reporting that international collaboration is important for access to capital (

yes

or

no

).

Split between firms with less than 5 FTEs and firms with 5 FTEs or more invested in PV.

5.3

Where are the customers?

Prior to conducting the survey, we assumed that OWP and PV firms would be mostly oriented towards

international markets. From

figure 5-19,we can see that this is confirmed for OWP but less so for PV

firms. This can be explained by the large number of system suppliers that are mainly small firms (see

figure 5-5)oriented towards a nascent domestic market.

Figure 5-19 Location of actual or potential customers. Percentage of firms.

Figure 5-20shows that when we count total number of full-time equivalents dedicated to OWP or PV

instead of number of firms, the international orientation becomes more pronounced. From this, we

recognise that the larger PV firms are oriented towards international markets. Thus, in terms of

resources, we can observe that both industries mainly target markets abroad.

0%

20%

40%

60%

80%

100%

Percentage of firms

International collaboration important

for access to capital

Less than 5 FTEs on PV 5 or more FTEs on PV

0%

20%

40%

60%

80%

Exclusively domestic Mostly domestic Equally domestic and

international

Mostly international

Exclusively

international

Percemtage of firms

OWP PV