24

I

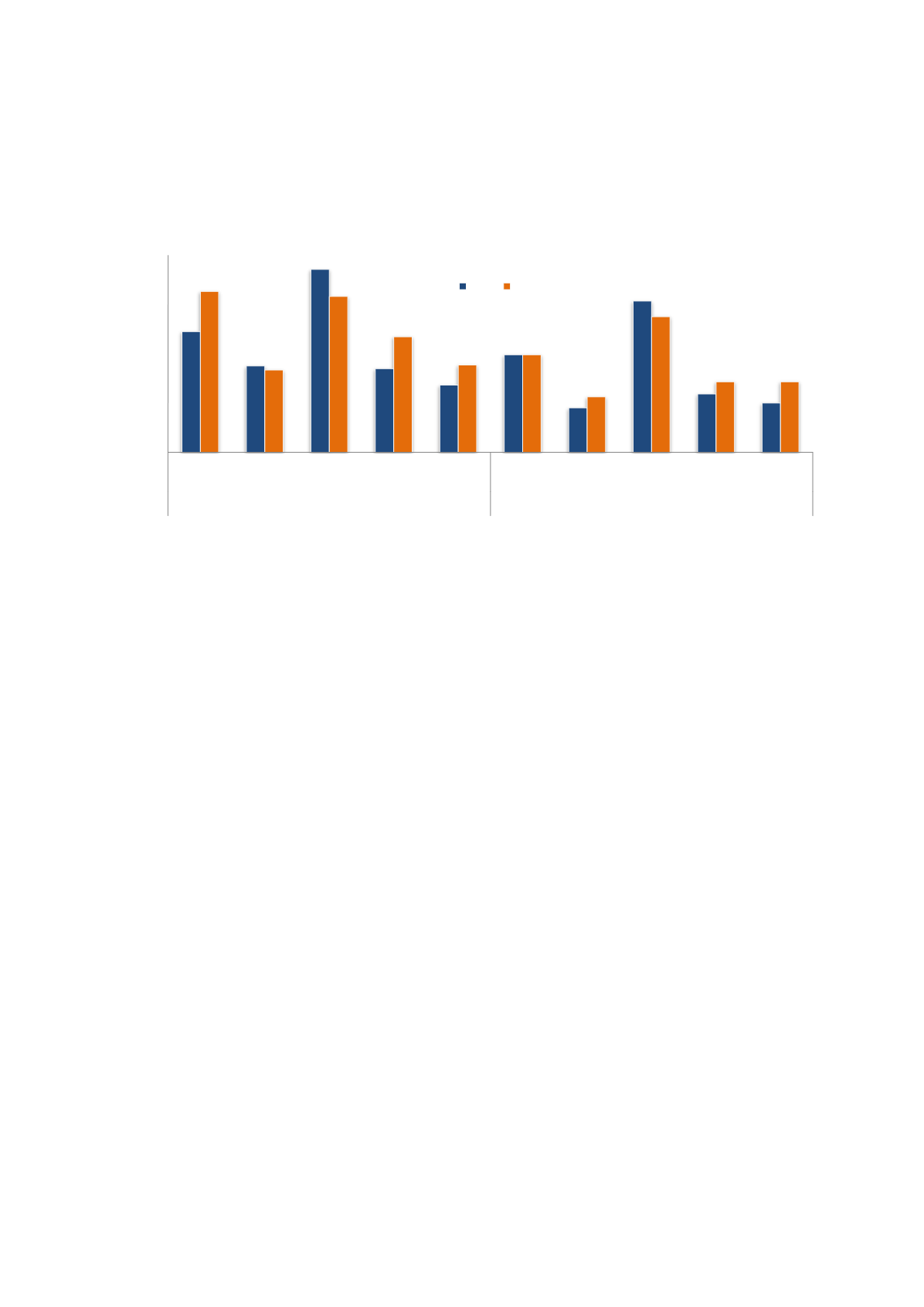

n figure 5-15,we can see that both offshore wind and photovoltaic firms participate quite extensively

in international collaborations. Moreover, we can notice that collaboration with customers is

particularly important, especially for OWP firms.

Figure 5-15 Percentage of firms that reported to collaborate with different international organisations on product

development and market access (answering

yes

or

no

).

Considering the perceived importance of international collaboration, it is interesting to note that 13

OWP and 7 PV firms have no collaboration with the international organisations that we asked about in

the survey. The PV firms can be explained by the fact that all of these firms are oriented exclusively or

primarily towards a domestic market. Many of the OWP firms, however, target primarily international

markets in the North Sea. For all but two of the firms with no international collaboration, OWP and PV

represent a very small share of the firms’ total revenue. This strengthens the impression that even

though there are a significant number of Norwegian firms participating in the OWP market, many of

these firms dedicate limited resources to activities in this market.

Figure 5-16 shows that whereas there is no relation between domestic collaboration and size of

investments in OWP and PV (in terms of FTEs), firms with significant investments in OWP and PV also

collaborate with a wider set of international organisations.

0%

20%

40%

60%

80%

Suppliers Competitors Customers Research

institutions

Public org. Suppliers Competitors Customers Research

institutions

Public org.

Collaborate on product development

Collaborate on market access

Percentage of firms

International collaboration

OWP PV