31

also observe that a larger proportion of OWP firms experience that their markets are dominated by

established firms than for PV. This is surprising given that PV could be seen as a more mature industry

than offshore wind.

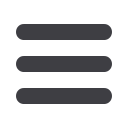

Figure 5-28shows the same barriers for the PV industry, split between PV system firms and all other

firms (delivering components and services to the PV supply chain). Here, we can see that the second

group (which consists mostly of firms producing silicon and other raw materials as well as firms

delivering consultancy and R&D services) to a greater extent than the system firms respond that the

market is dominated by established firms

. They also find it comparatively more

demanding to test and

qualify products or service

. Some of the firms producing raw materials have introduced novel products

and processes on the global market (Hanson 2013), which could explain a greater need to test and

demonstrate these products. However, as these firms are mostly oriented towards international

markets, this difference could also be explained with the importance of a home market for testing and

demonstration.

Figure 5-28 Perceived barriers for PV firms. Split between system firms and all other firms.

Respondents answered

yes

or

no

on whether each potential barrier was challenging for their activity in PV.

Moving over to offshore wind, we can only find minor variations across the supply chain. However,

figure 5-29shows that OWP firms with maritime as the core industry perceive

costs of product and

service development

as less of as a barrier compared to firms in other segments along the supply chain.

We interpret this as indicating that maritime activities in OWP are fairly similar to maritime operations

in other industries, and that costs of entry from maritime industries to OWP might be lower than for

firms with core activities in other industries.

0%

20%

40%

60%

80%

100%

Uncertain

demand

Access to

capital

Demanding to

find customers

Cost of

product and

service

development

Access to

qualified

labour

Demanding to

test and

qualify

product or

service

Geographic

distance a

challenge

Marked

dominated by

established

firms

Percentage of firms

PV system All other PV