34

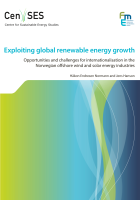

Figure 5-32 Percentage of firms that fully or partly consider the North Sea as a domestic market for offshore wind

In conclusion, we make two main observations based on the data presented in this section on the role

of home markets for offshore wind. First, a large number of firms do experience the lack of a domestic

market as a barrier to internationalisation. Second, the finding that larger firms depend less on the

presence of a domestic market (se

e figure 5-31)is perhaps not surprising. Large firms have more often

established international activities and are better equipped to handle risk. However, the Norwegian

industry structure consists of mostly small and medium-sized enterprises. The potential for these firms

to succeed in the international market for offshore wind may depend particularly on national policies

that target barriers to internationalisation encountered specifically by smaller firms.

5.6

Expectations for future development

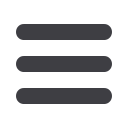

The level of activity in both offshore wind and solar PV amongst the surveyed firms has increased over

the last 3 years

. Figure 5-33 shows that about half of the surveyed firms report that the number of full-

time equivalents dedicated to OWP and PV has increased, whereas around 20 per cent of the firms

report that this has declined. Moreover,

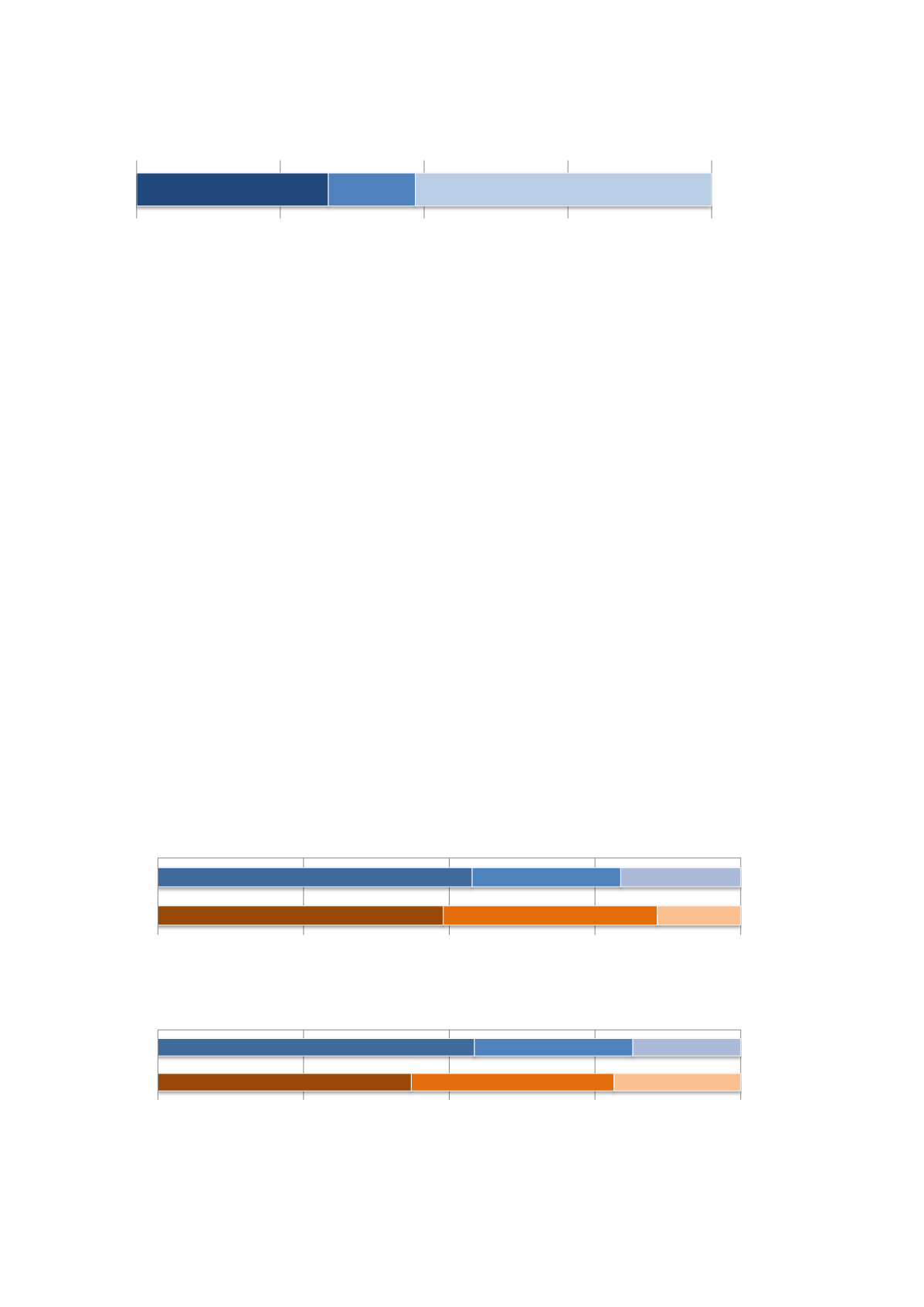

figure 5-34shows that the turnover from OWP and PV as a

share of total turnover has also increased for approximately half of the firms.

Figure 5-33 Development of number of full-time equivalents over the last three years

Figure 5-34 Turnover from OWP and PV as percentage of total turnover. Development over last three years.

Fully

Partly

None at all

0 %

25 %

50 %

75 %

100 %

To what extent does the North Sea replace the need for a domestic market?

Increased

Increased

Same

Same

Declined

Declined

0 %

25 %

50 %

75 %

100 %

OWP

PV

Percentage of firms

Increased

Increased

Same

Same

Declined

Declined

0 %

25 %

50 %

75 %

100 %

OWP

PV