Position Paper: CenSES Energy demand projections towards 2050

20

3.3.Industry sector

3.3.1. Energy service demand

The future Norwegian industrial energy demand is very uncertain and depends on several factors outside the

scope of this work (e.g. global demand of important products such as primary metals, prices of raw materials and

products, international competition etc.). Industry demand is highly dependent on a small number of decisions

with major impact on total Norwegian energy use. The reference path is therefore in principle based on

assumptions of constant activities and indicators of all industrial sectors (measured in ton or similar physical

production units). An increase of monetary activities combined with an equal decrease of the indicator, results

in the same energy demand. Close downs of plants or production increases carried out or decided up to 2014

are included in the projection. Recently have the decisions of the pilot plant at Karmøy and the electrification of

Utsira contributed to an increased electricity consumption of 2 - 3 TWh towards 2030, but this is not yet included

in the reference path. Investments in energy efficiency measures are not possible in the reference path, but in

the REF-EE scenario. In all analyses it is possible to invest in energy efficient heating plants such as heat pumps.

To illustrate the high degree of uncertainty of the industrial development, two alternate scenarios are analysed.

A strong focus on industry development in combination with constant energy prices at the present level is the

basis for the HIGH activity scenario. Lower industrial activities in combination with higher energy prices are

analysed in the LOW activity scenario. The key assumptions of the industry scenarios are described in Table 8

and the electricity specific demand is presented in Figure 11.

Compared to the present specific electricity demand, the reference path will increase the demand by 3.5 TWh in

2020 and by 1.7 TWh from 2030 to 2050. The reference scenario includes power from grid to some offshore

activities. The High activity scenario will increase the demand by 8 TWh in 2020 and more than 16 TWh from

2030. This scenario assumes increased production of energy intensive products such as aluminium and a high

electrification of the offshore activities. In the Low activity scenario (with high energy prices) the demand

decreases by 10 TWh from 2040. In this scenario, the power from grid to offshore activities will decrease from

the present level and be zero in the middle of the analysing period. It also includes the closing down of more

pulp & paper industries as well as some primary metal production.

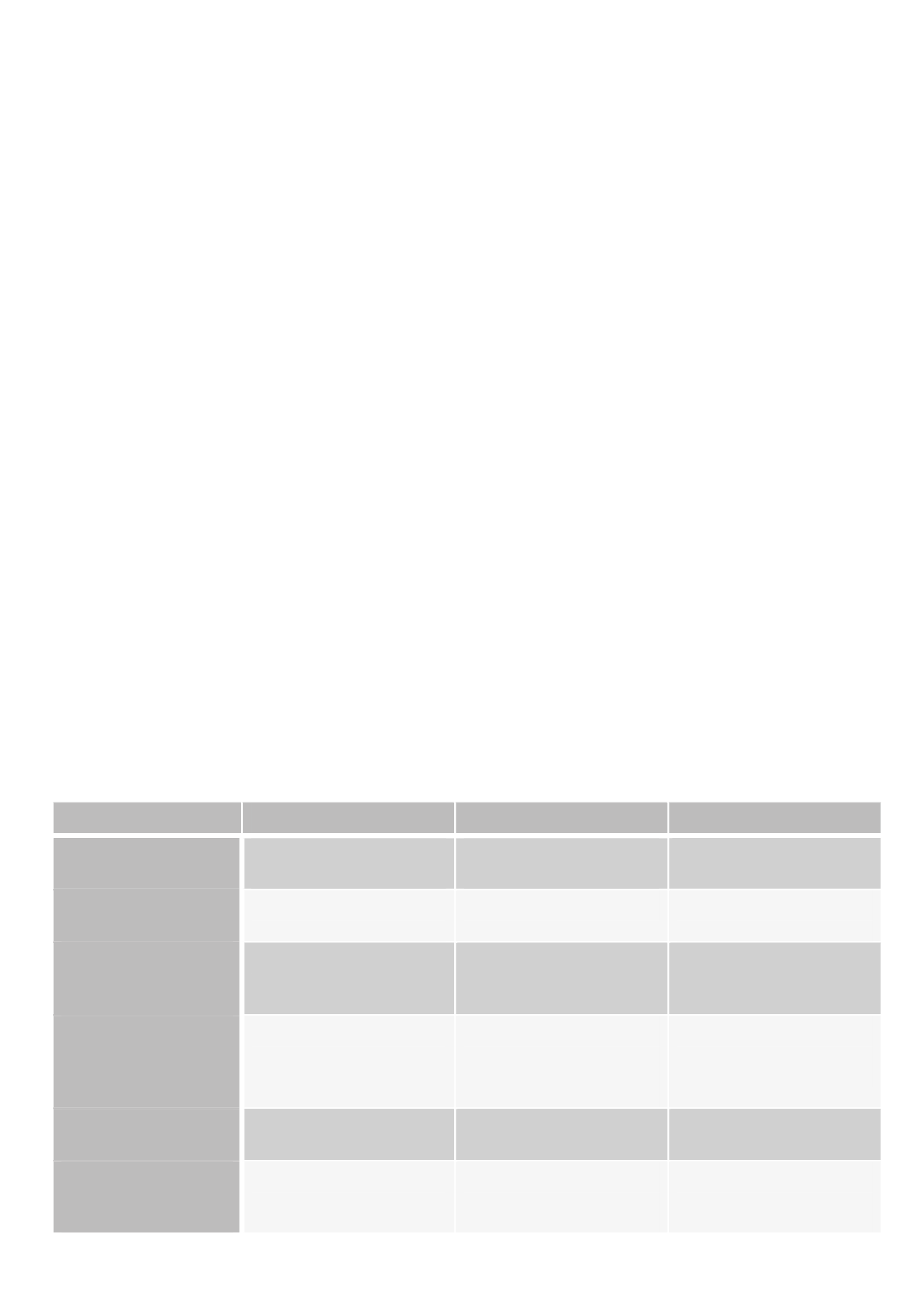

Table 8 Key assumptions of the industrial scenarios

REFerence path

HIGH activity scenario

LOW activity scenario

Aluminium production

Increased production at

Hydro Sunndal

- Pilot plant Hydro Karmøy

- New plant Hydro Karmøy

Other metal production

and chemical industry

Close down of REC,

Becromal in 2011-2012

Additional new production

Close down of metal

production plants

Pulp & paper

Close down of Tofte, Follum,

Moss, Hunsfos, Folla in

2011-2013

Close down of several pulp

& paper plants

Petroleum activities

Power from grid to Troll A,

Kollsnes, Valhall, Goliat,

Gjøa, Martin Linge, Ormen

Lange, Snøhvit

- Melkøya/Snøhvit power

from grid supply total

demand and a new train 2

- Utsira – power from grid

Decreased power from grid

to offshore petroleum

activities

Other industry

New industrial activity

Decreased activities of other

industry

Electricity specific

demand compared to

2010

+3.5 TWh in 2020

+1.7 TWh in 2030 - 2050

+8 TWh in 2020

+16 TWh in 2030

+17 TWh in 2050

-0.4 TWh in 2020

-4 TWh in 2030

-10 TWh in 2040

4.3. Industry sector

4.3.1. Energy service demand

The future Norwegian industrial energy demand is very

uncertain and depends on several factors outside the

scope of this work (e.g. global demand of important

products such as primary metals, prices of raw materials

and products, international competition etc.). Indus ry

demand is highly dependent on a small number of

decisions with major impact on total Norw gian energy

use. The referen e path is therefore in principle ba ed

on assumptions of constant activities and indicators

of all industrial sectors (measured in ton or similar

physical production units). An increase of monetary

activities combined with an equal decrease of the

indicator, results in the same energy demand. Close

downs of plants or production increases carried out

r decided up to 2014 are included in the pr jection.

Rece tly have the deci ions of the ilot pla t at Karmøy

nd the electrification of Utsira contributed to an

increased electricity consumptio of 2 - 3 TWh towards

2030, but this is not yet included in the ference

path. Investments in energy efficiency measures are

not possible in the reference path, but in the REF-EE

scenario. In all analyses it is possible to invest in energy

efficient heati g plants such as heat pumps.

To illu trate the high degree of uncer ainty of the

industrial development, two alternate scenari s are

Table 8

Ke ssumptions of the industrial cenarios

analysed. A strong focus on industry development in

combination with constant energy prices at the present

level is the basis for the HIGH activity scenario. Lower

industrial activities in combination with higher en rgy

prices are analysed in the LOW activity scen rio. The key

as umptions of the i dustry cenarios ar described i

Tabl 8 and the electricity specific demand is pre nted

in Figure 11.

Compared to the present specific electricity demand,

the reference path will increase the demand by 3.5

TWh in 2020 and by 1.7 TWh from 2030 to 2050. The

reference scenario includes power from grid to some

offshore activities. The High activity scenario will

increase the demand by 8 TWh in 2020 and more than

16 TWh from 2030. This s n rio assumes incr ased

production of e ergy intensive products such as

aluminium and a high electrification of th offshore

activities. In the Low activity scenario (with high energy

prices) the demand decreases by 10 TWh from 2040. In

this scenario, the power from grid to offshore activities

will decrease from the present level and be zero in the

middle of the analysing period. It also i cludes the

closing down of more pulp and pa er industries as well

as some p imary metal production.