15

for onshore wind where the turbine typically account for between two-thirds and three-quarters of

total installed costs (IRENA 2015b). Thus, a large share of the value can be captured from other parts

of the OWP value chain. For instance, the value of logistics and installation has been estimated to

around 20 per cent, electrical infrastructure to around 12 per cent and foundations and support

structures to around 25 per cent (Navigant 2013). A number of other services such as those related to

meteorological and oceanography, maintenance and IT also contribute to the offshore wind supply

chain. In this report, we use the following categories along the OWP supply chain: (1) topside, (2)

foundation, (3) electrical and grid, (4) logistics, installation, vessels, (5) metocean, survey, subsea, (6)

R&D, consultancy, IT (7), operations & maintenance and (8) other. We should here note that R&D,

consultancy and IT services might contribute to all other parts of the supply chain.

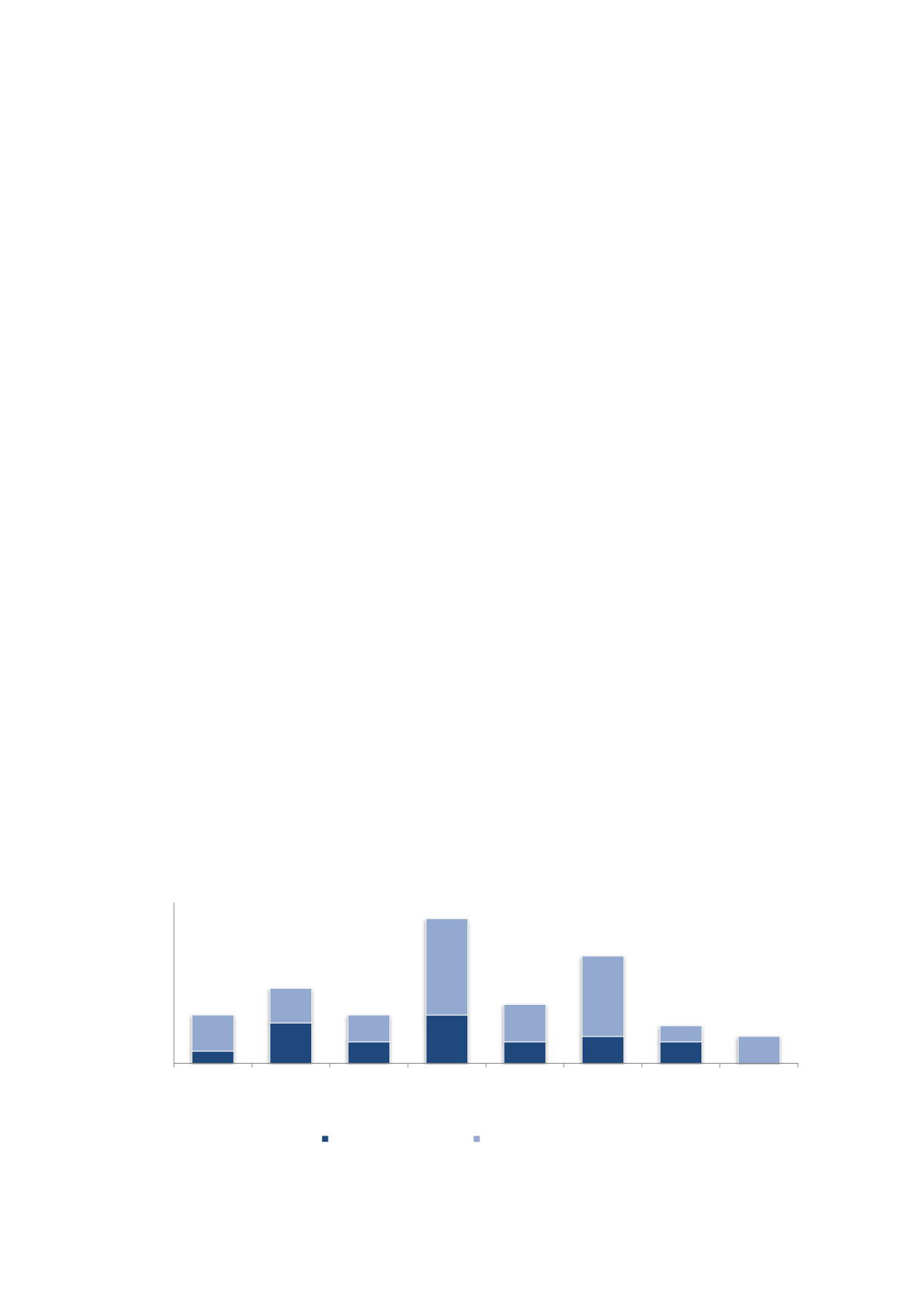

Figure 5-4shows that the OWP firms are spread across the entire supply chain, but with a large share

of the firms engaged in logistics and installation. Many of these firms build or supply vessels for

installation, maintenance and transport. There are also a number of firms that deliver services such as

surveying, IT systems, metocean services (meteorology and oceanography) and consultancy. Finally, a

significant number of firms also manufacture components that are part of the topside, foundation or

electrical infrastructure of offshore wind farms. In addition to variation in terms of place in supply

chain, we also see that firms deliver a broad variety of products and services within each category. For

instance, within the topside category we find firms supplying products ranging from cable

management systems and fiber reinforcements to specialised wind turbine technology.

Figure 5-4also shows the share of firms in each category that have dedicated five or more full-time

equivalents to OWP. From this, we can for instance see that the more than half of the firms in the

foundation and O&M categories have made significant investments in OWP, whereas firms delivering

topside products or services have for the most part dedicated less resource to this industry.

Figure 5-4 Number of firms across the OWP supply chain

Source:

Survey data and desktop research

0

5

10

15

20

25

30

Topside Foundation Electrical &

Grid

Logistics,

Installation &

Vessels

Metocean,

Survey, Subsea

R&D,

Consultancy

and IT

O&M Other

Number of firms

5 or more FTEs on OWP Less than 5 FTEs on OWP