14

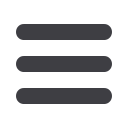

Figure 5-2 Number of full-time equivalents and percentage of company revenue in PV and OWP

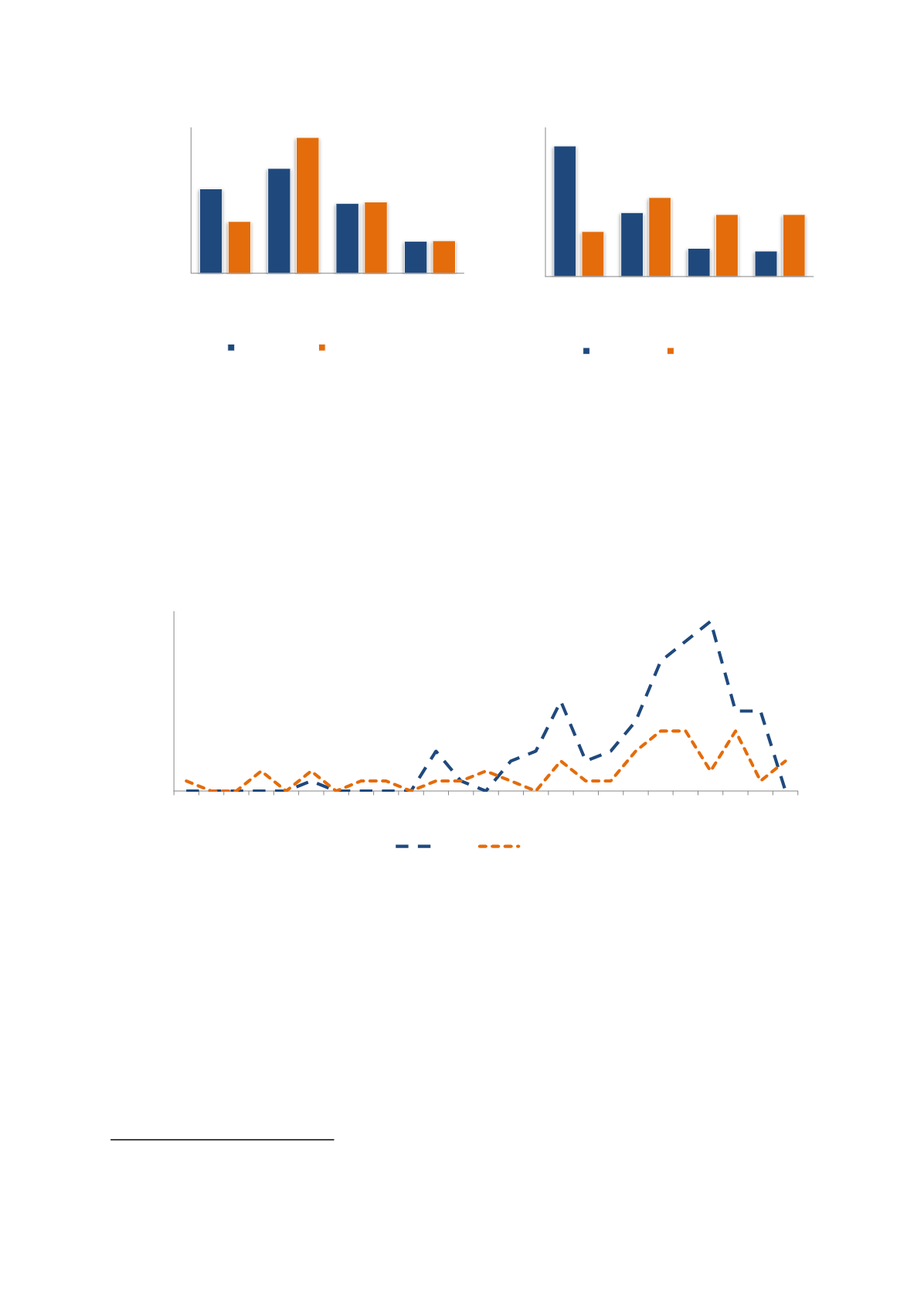

We also asked the firms about when they first started up activities related to the offshore wind and

solar PV industries. Figure 5-3 shows that there was little activity, in terms of new firm entry, before

the year 2000, and that following a surge in activity in the period between 2005 and 2012 activity was

reduced in the subsequent years. This is particularly visible for the offshore wind firms, and may be

related to changing activity levels in the petroleum industry in the same period (Normann 2015).

Figure 5-3 Annual number of firms starting activity in OWP and PV (1990-2014)

5.1.1

Supply chains

Both the offshore wind and photovoltaics industries consist of a variety of firms that supply different

products and services

2. An offshore wind farm is put together by three groups of manufactured

components: topside, foundations and electrical infrastructure. The turbine is the main topside

component and the single most expensive part of the OWP value chain, representing approximately

one-third of the total costs of an offshore wind farm. This is however a significantly smaller share than

2

Many of the firms reported to have activities in several categories in the supply chain. For the purpose of our analysis, we placed these

firms in only one category in the supply chain (see sectio

n 3 for more details about this process).

0%

10%

20%

30%

40%

50%

<1

1-4

5-25

>25

% of firms

Number of FTEs dedicated to OWP and PV (2014)

OWP (n=100)

PV (n=45)

0%

10%

20%

30%

40%

50%

60%

1-4 % 5-20 % 21-80 % 81-100 %

% of firms

Activity in OWP and PV as % of total revenue (2014)

OWP (n=97)

PV (n=44)

0

2

4

6

8

10

12

14

16

18

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

Number of firms

OWP

PV