10

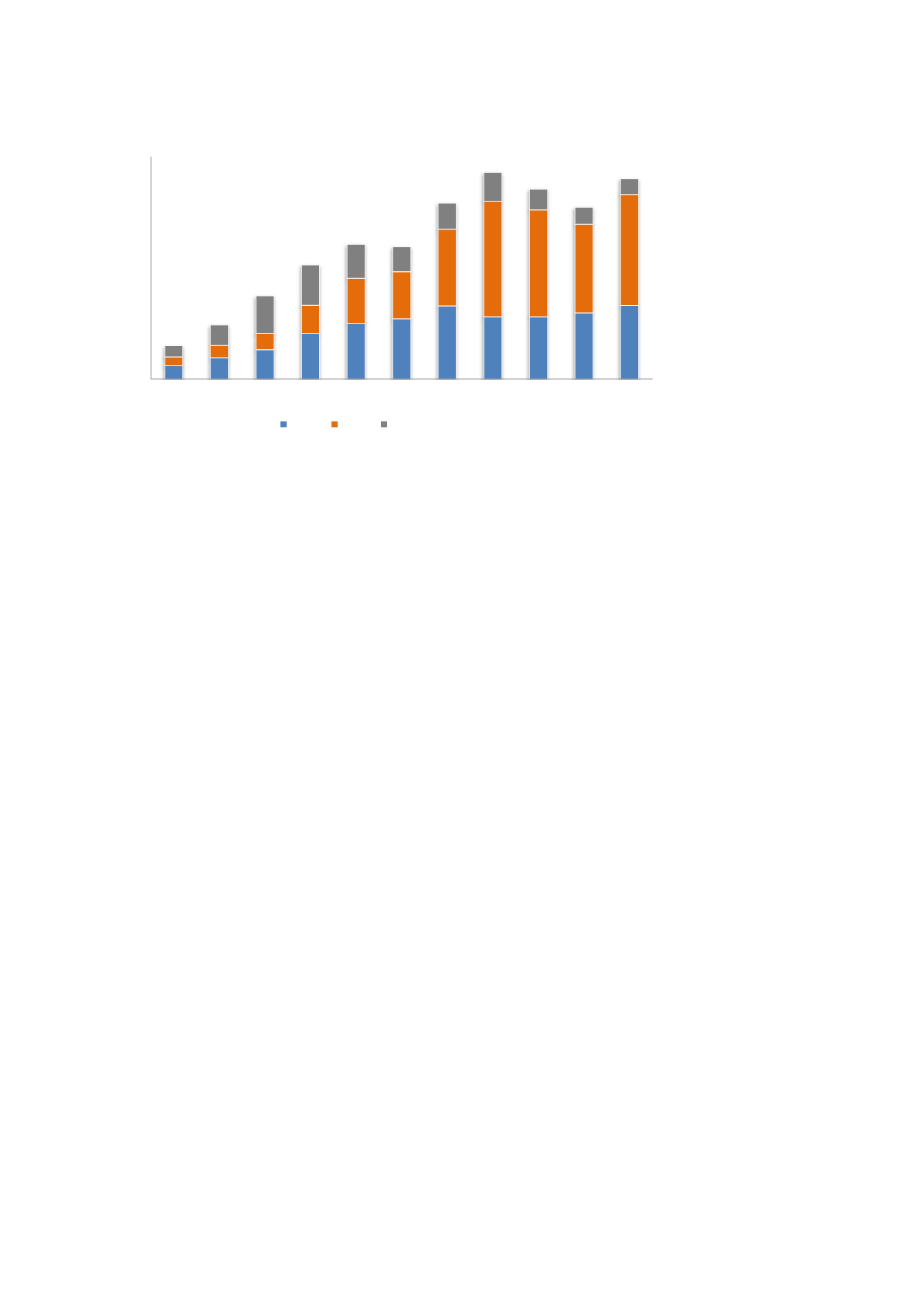

Figure 4-1 New investments in renewable energy excluding large hydro, 2004-2014, $bn.

Includes estimates for undisclosed deals.

Source: UNEP, Bloomberg New Energy Finance

In the case of PV, this growth has resulted in dramatic reductions in cost of electricity (se

e figure 4-2),

which in turn has further contributed to market growth. PV costs have been reported to have fallen

with 80% since the end of 2009, with PV gaining competitiveness with fossil-fuel fired electricity costs

in some regions (IRENA 2015a).

The development of offshore wind has followed a different trajectory. Although OWP is a technology

with large potential, it is also a technology that has been confronted with difficulties. Despite increased

investments in both R&D and deployment, the cost of electricity increased in the period between 2008

and 2013. This increase in costs can largely be explained by projects being developed further off shore

in deeper waters, cost overruns due to harsh environments and complexity of construction at sea,

increased steel prices, and lack of competition in the turbine market. However, estimated costs for

recent projects such as the Horns Rev 1 project developed by Vattenfall shows that substantial cost

reductions can been made (Danish Ministry of Energy 2015). Nevertheless, we note a significant

difference between OWP and PV in that the value of the PV market and the estimated share of the

total electricity market for PV is substantially larger than the market for OWP. Moreover, whereas

OWP will depend on subsidies in order to compete with more cost-efficient technologies for some time,

PV is today competitive without subsidies in some markets (IRENA 2015b).

0

50

100

150

200

250

300

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

New investments in renewable energy last decade

Wind Solar

Other (ex. large hydro)