11

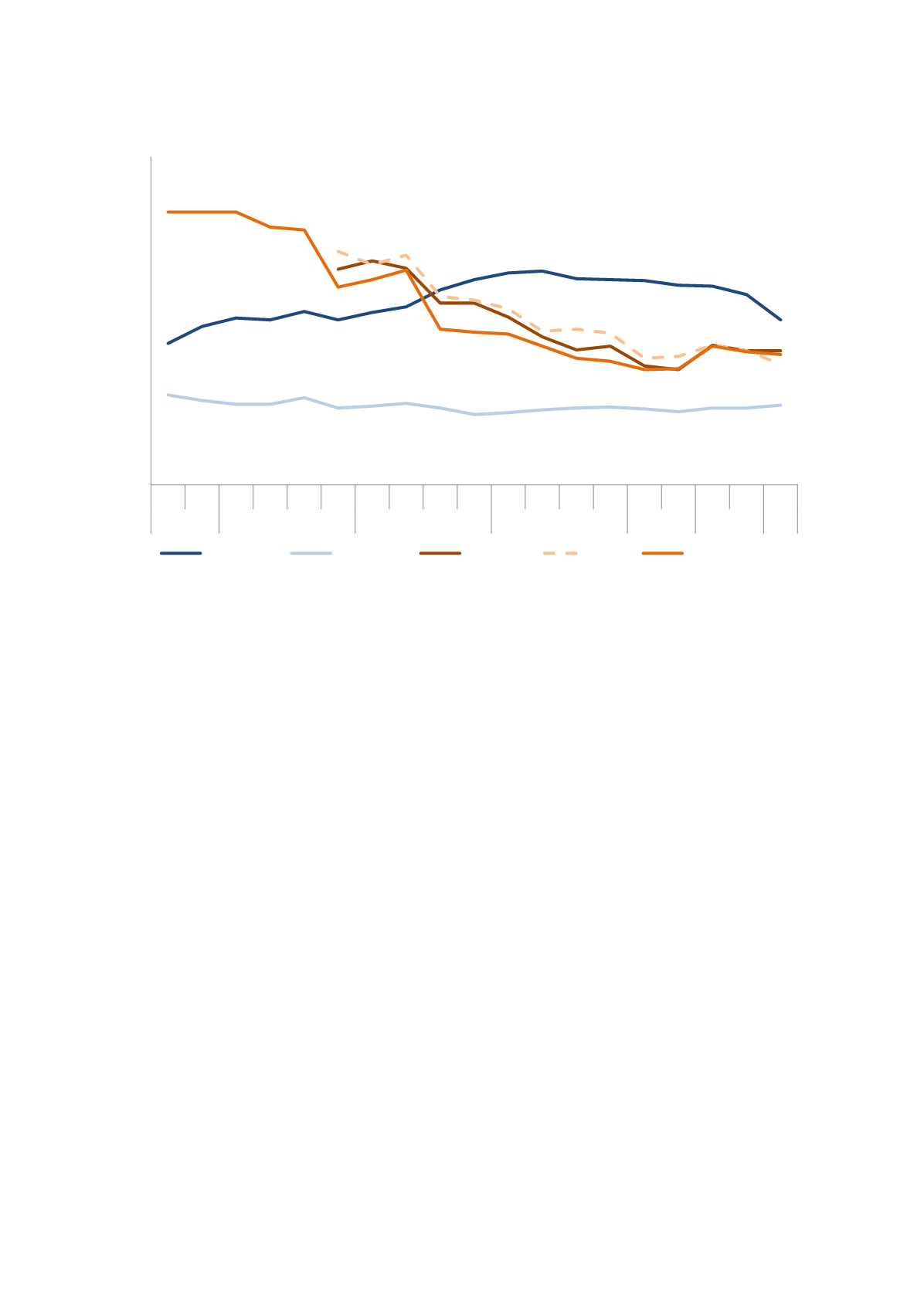

Figure 4-2 Global average levelised cost of electricity for wind and PV, Q3 2009 to H1 2015, $ per MWh.

PV-c-Si stands for crystalline silicon photovoltaics

Source:

Bloomberg New Energy Finance

The value of the global PV market for 2014 has been estimated at approximately 600 billion NOK,

whereas the value of the offshore wind market in 2014 has been estimated at around 60 billion NOK.

However, Norwegian actors have only captured a small share of these markets (Slengesol 2015a).

Export Credit Norway estimate that in 2014 Norwegian suppliers sold products and services to

international offshore wind projects worth around 3 billion NOK, which gives a market share of about

5 per cent (Slengesol 2015b). Norwegian exports to the PV industry have been estimated to 2-2.3

billion NOK, which equals to just above 0,3 per cent of the global PV market (Slengesol 2015a). Both

these industries in Norway thus have a marginal share of global markets.

4.2

Offshore wind in Norway

As a European market for offshore wind emerged in the 2000s, a number of Norwegian firms started

to explore opportunities in the offshore wind industry by developing products and solutions that

exploited technology, resources, and competencies from the maritime and oil and gas industries

(Hansen & Steen 2011; Normann 2015; Steen & Karlsen 2014). These firms included entrepreneurial

start-ups such as Owec Tower and Sway, industrial actors such as Aker Verdal, as well as large energy

companies such as Lyse, BKK, Statoil and Statkraft. This development gained momentum around 2007

and 2008 when the financial crisis and reduced offshore activity put pressure on the suppliers to the

0

50

100

150

200

250

300

350

Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 H1 H2 H1 H2 H1

2009

2010

2011

2012

2013

2014 2015

Levelised cost of electricity for OWP and PV, Q3 2009 to H1 2015, $ per MWh

Offshore wind

Onshore wind

PV - thin film

PV - c-Si

PV - c-Si tracking