Background

In the EU there are ambitious targets for

increasing the renewable electricity generation,

especially wind- and solar-power. Due to the

stochastic characteristics of the renewable

generation, additional balancing is needed to

secure a stable power grid. The Norwegian

government recently gave concession to build

two HVDC cables, 1400 MW both to Germany

and UK, giving Norwegian hydro producers

access to balancing markets at the European

continent. My PhD will focus on methods for

implementing additional markets, such as the

balancing reserves markets, in hydropower

scheduling models.

Due to the underlying uncertainty of inflow and

power prices, hydropower scheduling for long-

term models are considerably difficult to solve.

The amount of potential stochastic outcomes

explode over time, potentially diminishing the

computational tractability. In order to cope with

thisissuethemethodofStochasticDualDynamic

Programming (SDDP) has proven beneficial for

solving these types of problems. The method

is, however, based on Linear Programming

(LP), such that to model the added complexity

provided by balancing reserve markets, e.g.

integer bids and minimum production limits, is

cumbersome.

Themainpurposeof thePhD is to investigateand

potentially develop methods for incorporating

multi-market hydropower scheduling.

PHD THESIS

Department of Electric

Power Engineering

2015-2018

Integrating Balancing

Markets in Hydropower

Scheduling Models

Supervisor:

Magnus Korpås

Co-supervisor:

Arild Helseth and Gerard

Doorman

Martin N. Hjelmeland

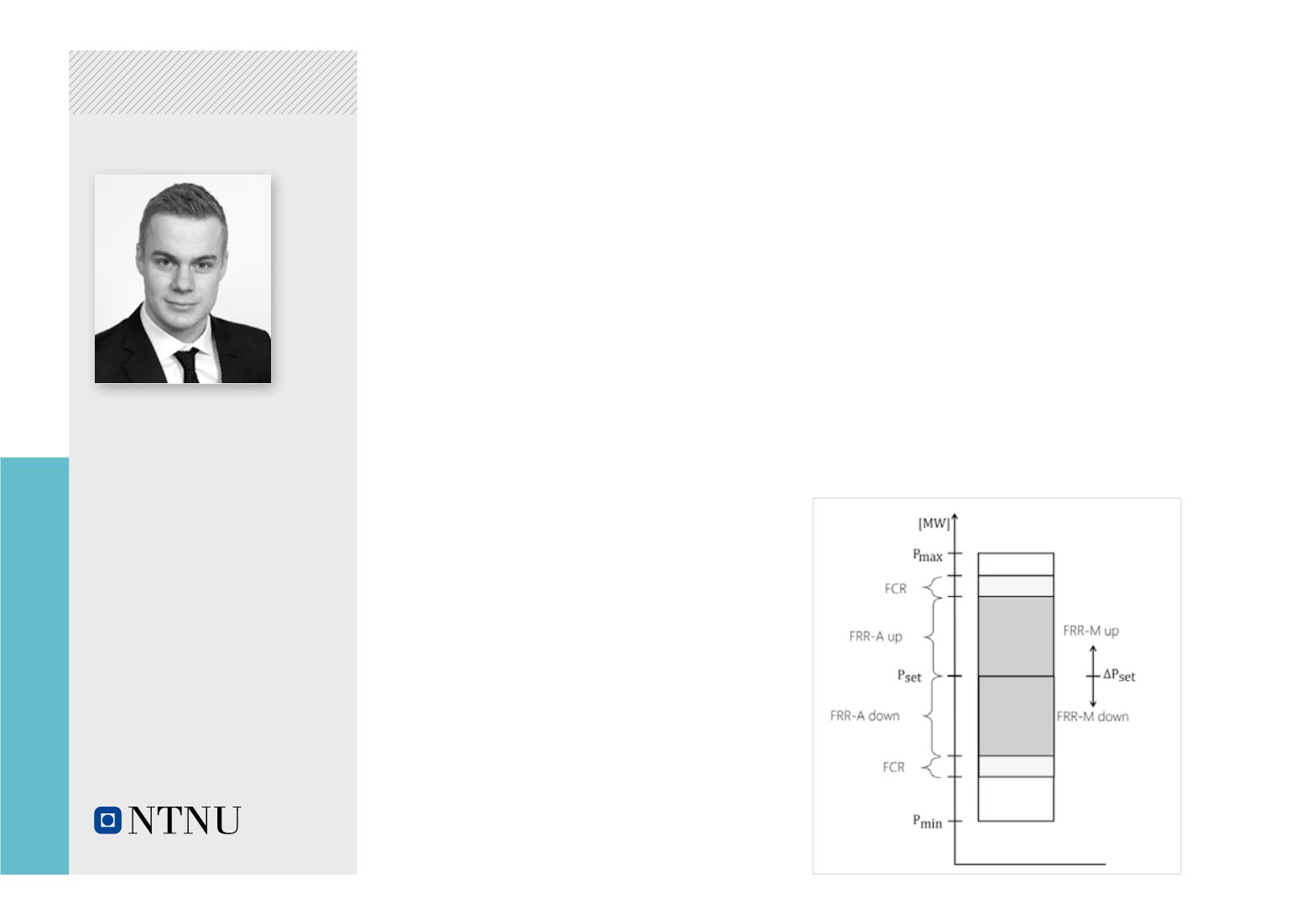

Illustration of different balancing reserves

that could be provided from a hydropower

station. FCR, FRR-A and FRR-M

respectively refers to primary, secondary

and tertiary balancing reserves

80